Our world is increasingly characterized by environmentally conscious thinking. Companies are required to integrate sustainable practices in order to minimize their environmental impact. At the same time, this offers them a unique opportunity to gain a competitive advantage. By acting responsibly, they convince both their employees and their customers.

Regulatory requirements are aimed at integrating ESG criteria into business processes and taking sustainability aspects into account. With ESG reporting, companies also strengthen the trust of their stakeholders. Digitalization makes it possible to bundle all the necessary ESG data and keep an eye on it at all times. Innovative and sustainable software solutions can optimize resource consumption and thus contribute to combating climate change.

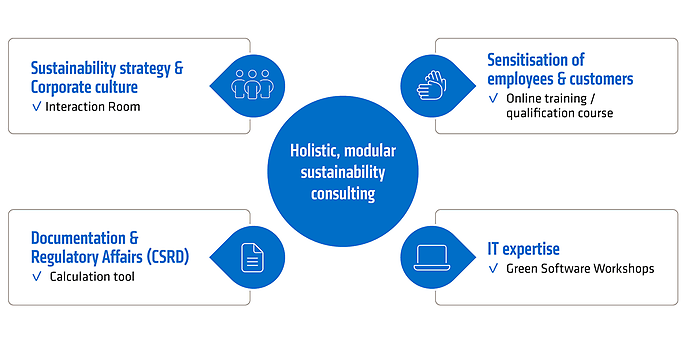

adesso accompanies you on your path of transformation into a sustainable insurance company. With modern technology and comprehensive know-how, we support you in achieving your sustainability goals and positioning yourself on the market as a responsible, future-oriented company.